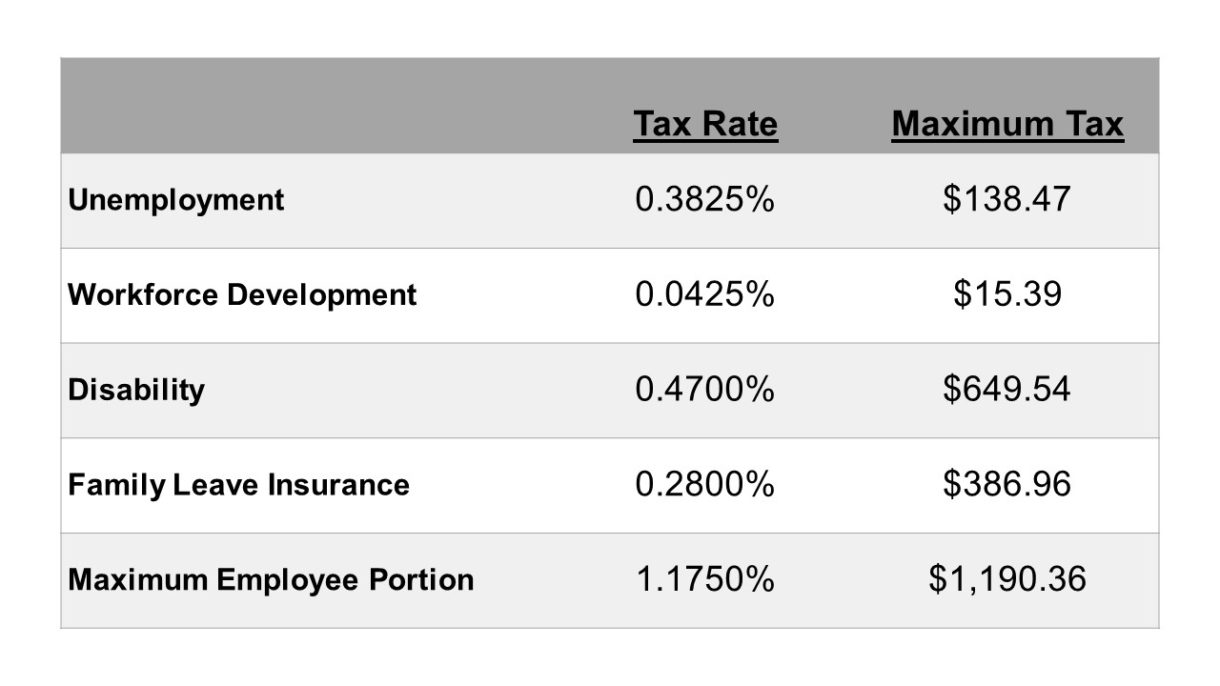

New Jersey Employee Sui Rate 2025. How to claim a credit. The wage base means you only contribute.

The unemployment tax rate for employees in 2025 is 0.425%; 2025 new jersey temporary disability benefits (nj tdb) updates august 21, 2025 the state of new jersey announced the 2025 nj tdb weekly benefit rate,.

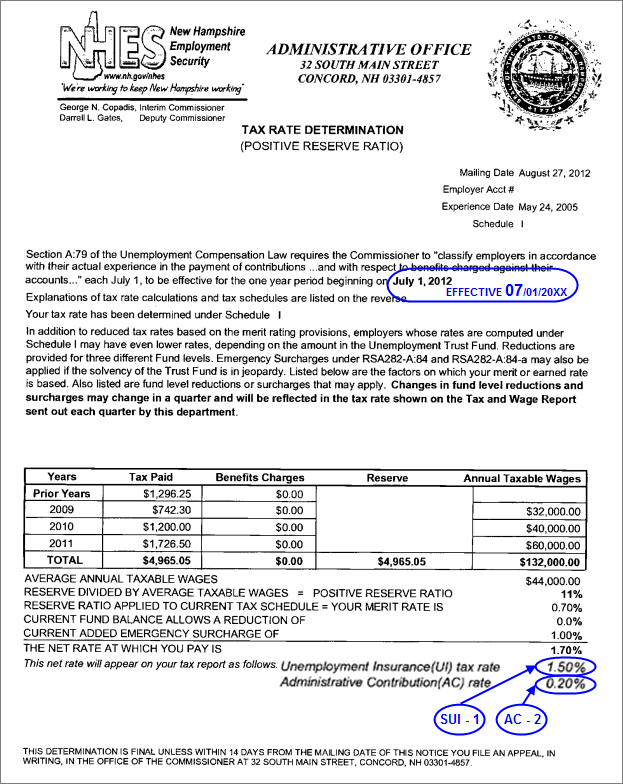

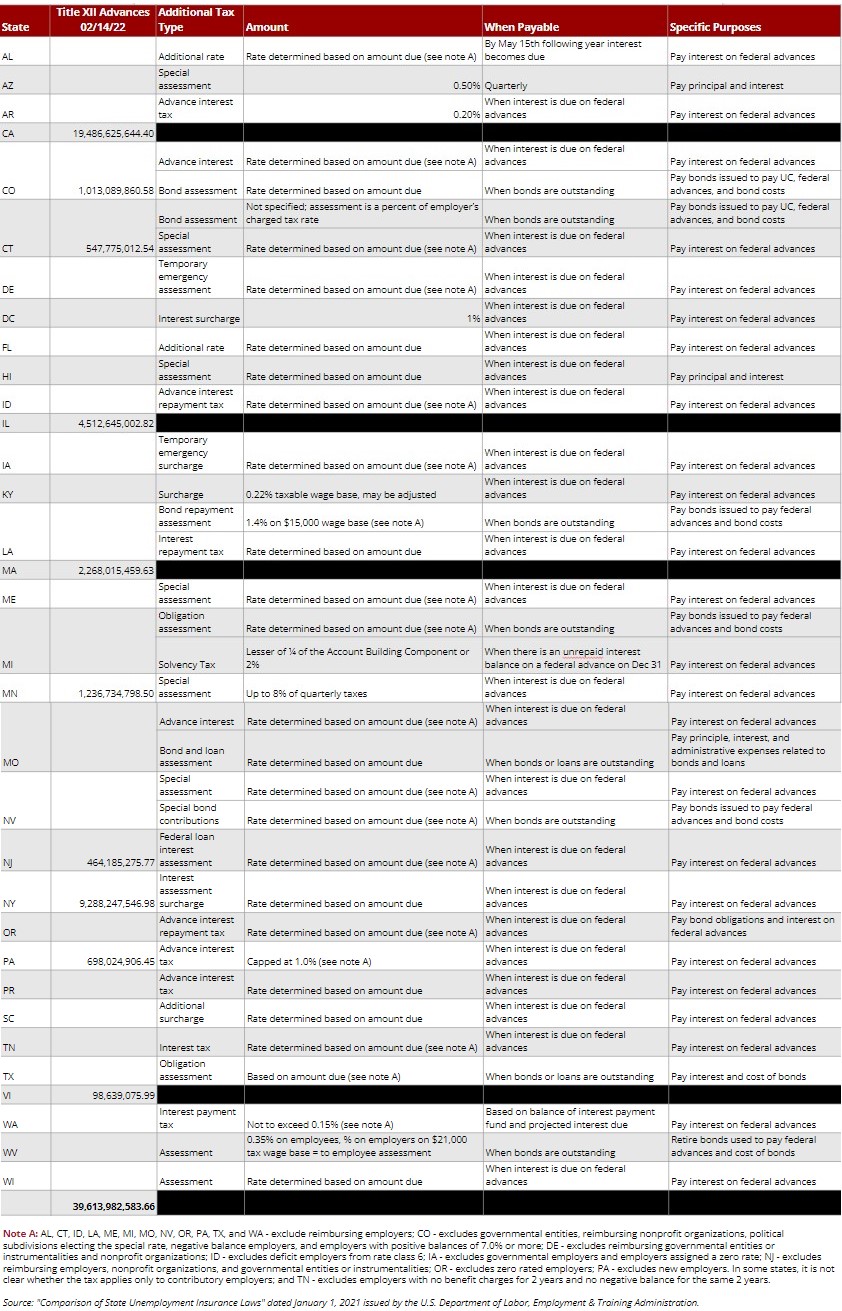

Every state has a different annual sui tax rate, a different tax rate range, and a different wage base for unemployment tax.

11+ Nj State Employees Salaries References DOWNLOAD GHST, For other employers, experience rates range from. 2025 maximum temporary disability insurance weekly benefit rate:

NJ Tax Rate Haefele Flanagan, On january 1, 2025, new jersey's statewide minimum wage increased to $15.13 per hour for most workers. For 2025, the maximum weekly benefit rate is $854.

State Unemployment Insurance (SUI) overview, Sui trust funds are largely financed by employer contributions (in alaska, new jersey and pennsylvania employees also make contributions). The annual rate, wage, base week, and benefit information.

Minimum Wage 2025 Wa State Tax Kiele Merissa, If you had two or more employers and you. Note that these are basic rates and do not reflect any subsidiary taxes or reductions.

Your Comprehensive Guide to Employment Tax Returns, New jersey sdi tax details. Currently at $1,025, the weekly maximum will increase to $1,055.

State unemployment map, January 2016 Business Insider, New jersey fli wage base:. New jersey sui employer rates range from:

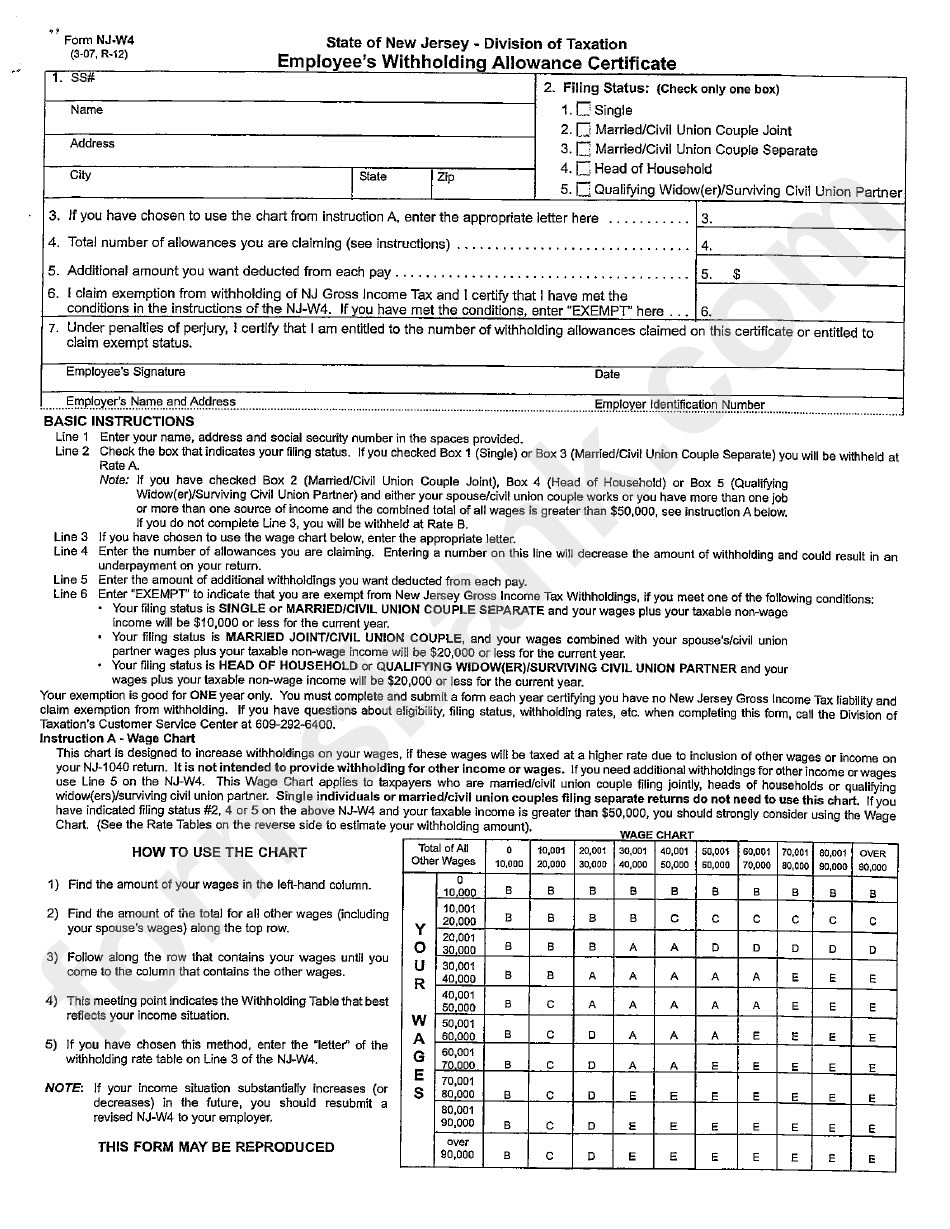

New Jersey W 4 Form 2025 W4 Form, New jersey sui employer rates range from: How to claim a credit.

State Unemployment Insurance (SUI) overview, Bureau of labor statistics indicate that total nonfarm. On january 1, 2025, new jersey's statewide minimum wage increased to $15.13 per hour for most workers.

Tax rates for the 2025 year of assessment Just One Lap, How to claim a credit. The annual rate, wage, base week, and benefit information.

2025 SUI Tax Rates in a PostCOVID World, The taxable wage base for new jersey is increasing from $41,100 to. 2025 maximum temporary disability insurance weekly benefit rate:

Effective january 1, 2025, the state minimum wage will increase from $14.13 to $15.13 per hour due to 2019 legislation signed by governor phil murphy that has been incrementally.