2025 Revised Rmd Table For Ira. In april, the internal revenue service waived penalties for beneficiaries of individual retirement accounts subject to required minimum distributions under the 10. We cover the basics here.

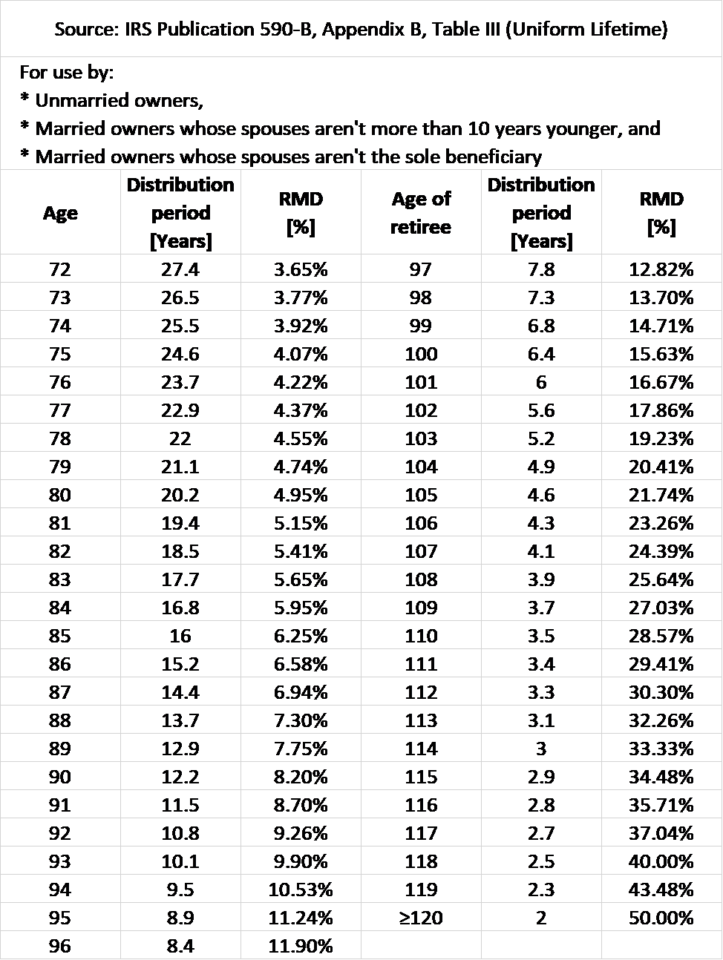

Here is the rmd table for 2025, which is based on the irs’ uniform lifetime table, which is the most widely used table (it is table 3 on page 65). Plus review your projected rmds over 10 years and over your lifetime.

The revised proposed regs greatly simplified the rules for calculating the rmd, as well as providing a longer time over which a taxpayer can take minimum distributions.

Required Minimum Withdrawal 2025 Ynes Amelita, Rmd rules and calculations can be confusing, and secure act 2.0 didn’t simplify things. What's new with required minimum distributions?

Rmd Table 2025 Leena Amabelle, In april, the internal revenue service waived penalties for beneficiaries of individual retirement accounts subject to required minimum distributions under the 10. We cover the basics here.

Irs Actuarial Tables For Ira Awesome Home, The irs on april 16 issued guidance on certain specified required minimum distributions (rmds) for 2025. This quick reference guide can help you talk to your clients about timing.

Uniform Table For Rmd 2025 Olwen Aubrette, The irs has other tables for account holders and beneficiaries of retirement funds whose spouses. What's new with required minimum distributions?

Rmd Tables For Ira Matttroy, And the irs just announced it has waived that rule. Use our required minimum distribution (rmd) calculator to determine how much money you need to take out of your traditional ira or 401(k) account this year.

Rmd Table For Inherited Ira Matttroy, Your yearly rmd is calculated using a formula based on the irs’ uniform lifetime table. What's new with required minimum distributions?

Rmd Tables For Ira Matttroy, If an rmd is required from your ira, the trustee, custodian, or issuer that held the ira at the end of the preceding year must either report the amount of the rmd to you, or offer to calculate it for you. If you're turning age 73 this year, it's time to start taking the annual required minimum.

Uniform Lifetime Table 2025 Irs Elset Horatia, The irs on april 16 issued guidance on certain specified required minimum distributions (rmds) for 2025. What you need to know about calculating rmds, aggregation rules, and strategies to reduce rmds.

Ira Required Minimum Distribution Table, What's new with required minimum distributions? As the 2025 rmd calculation is based on the account value as of december 31, 2025 and the irs’s rmd table calculation, the 2025 rmd needs to be withdrawn.

Roth Ira Required Minimum Distribution Table Elcho Table, Rmd rules and calculations can be confusing, and secure act 2.0 didn’t simplify things. Plus review your projected rmds over 10 years and over your lifetime.

As the 2025 rmd calculation is based on the account value as of december 31, 2025 and the irs’s rmd table calculation, the 2025 rmd needs to be withdrawn.

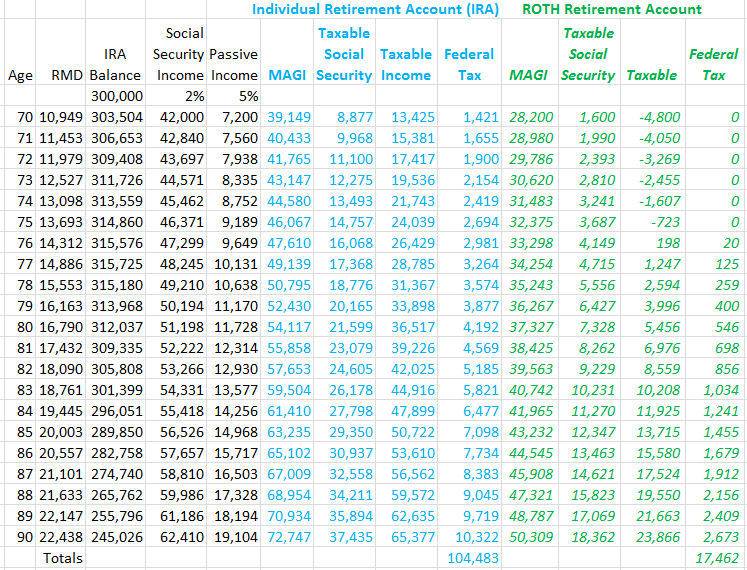

Our free ira rmd calculator is specifically designed for individuals who are already 73 years or older.